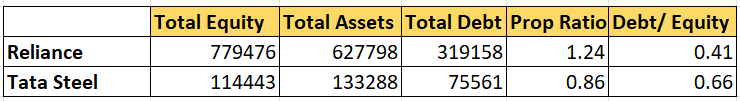

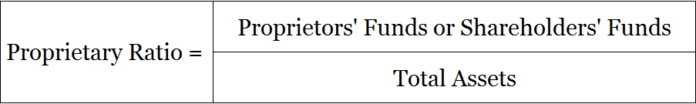

Solvency ratios, including the proprietary ratio, help stakeholders assess whether a company has enough equity and asset reserves to sustain its debt. Companies with stronger solvency tend to have a more secure financial foundation, reducing risks for investors and creditors. A proprietary ratio measures the proportion of a company’s assets that its fund finance. In contrast, a debt-to-equity ratio measures the amount of debt financing relative to equity financing. Proprietors’ funds include equity share capital, preference share capital, reserves, and surplus. Total assets refer to all company-owned assets, including fixed assets, current assets, investments, and other assets.

What is your risk tolerance?

Together, these ratios offer a well-rounded view of a company’s financial standing. The Proprietary Ratio, also known as the Equity Ratio, is a financial metric that measures the proportion of total assets funded by owners’ equity. It shows the contribution of owners in the total capital of the business and provides insight into the company’s financial leverage and solvency. The proprietary ratio is a financial ratio that measures the proportion of a company’s total assets that are financed by its shareholders’ equity.

How creditors use the proprietary ratio

Creditors often use the proprietary ratio to gauge a company’s financial health before extending credit. This ratio helps them understand how much of the company’s total assets are financed by shareholders’ equity. A higher ratio implies that the company is less dependent on external financing, which lowers the risk for creditors.

How Does GooglePay Earn Money? (GooglePay Business Model Revealed)

Proprietary ratio is a type of solvency ratio that determines the amount or contribution of shareholders (i.e., proprietors or owners) towards the total assets (usually total tangible assets) of an entity. Solvency ratios are those ratios that measure an enterprise’s capability to meet its long-term obligations. Such measures are made using parameters, like the value of long-term debt, the assets available within the organisation, the funds invested in the firm, etc. Thus, shareholders have contributed 40% of all funds used in the business, with creditors contributing the remaining 60% of funds. This ratio can be monitored on a trend line or compared with the same metric for competitors to gain a better understanding of the outcome. Proprietary ratio (also known as Equity Ratio or Net worth to total assets or shareholder equity to total equity).

- Therefore, the Proprietary Ratio is often used in conjunction with other financial ratios when analyzing a company’s financial health.

- As you can see from the formula, you must take the amount of equity provided by equity shareholders and divide that by the company’s total assets.

- The proprietary ratio, also known as the equity ratio, holds significant value in understanding the financial health of an organization.

- The proprietary ratio is one type of solvency ratio that is not used like commonly used ratios and very few investors use the proprietary ratio.

Additionally, the risk of insolvency or bankruptcy reduces considerably, which means the availability of loans at a lower interest rate. However, if the proprietary ratio is too high, the management cannot utilize the debt financing options wisely to generate profit. The solvency ratio is a critical financial measure that evaluates a company’s ability to meet its long-term debt obligations. It indicates the proportion of a company’s total assets financed by equity and debt, offering insight into the financial health and stability of a business. A higher solvency ratio suggests that the company is more capable of sustaining its debt load over time, while a lower ratio raises concerns about potential financial distress.

Debt-To-Equity Ratio

Ask a question about your financial situation providing as much detail as possible. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration like-kind exchange requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Therefore, the proprietary ratio is a significant measure in finance for decision making and future investment planning. It also shows a huge portion of debts in the total assets may minimize the creditor’s interest and increase the finance costs. Total assets include long-term assets & short-term assets include goodwill etc as per the balance sheet. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Therefore, maintaining a balanced proprietary ratio is crucial for any business.

The proprietary ratio is also known as the equity ratio or the net worth to total assets ratio. In contrast, a low ratio may indicate that the company should retain its earnings to improve its financial position. The debt service coverage ratio is a measure of a company’s ability to meet its fixed debt payments. The formula for calculating the debt service coverage ratio is net income before interest and tax divided by fixed interest charges. To calculate a company’s current ratio, divide its total current liabilities by its total current assets. When the debt-to-equity ratio is high, it means that creditors have invested more in a business than the owners, and the creditors will suffer more in adverse times than the owners.

To understand the proprietary ratio fully, it’s important to break down its components. The numerator in the ratio is the shareholders’ equity, which includes equity share capital, reserves, and surplus. The denominator is the total assets of the company, which includes fixed assets, current assets, and investments. This means that 70% of TechCo Inc.’s total assets are financed by the shareholders’ equity. This suggests that TechCo Inc. relies less on debt and more on equity for its financing, which could indicate a stronger financial position.

Analysts should be monitored on a trend line to gain a reasonable understanding of the ratio.