This strengthens its balance sheet and makes it less vulnerable to interest rate changes or economic downturns. Companies with a high proprietary ratio are often perceived as more financially secure, which can positively influence their credit ratings and ability to secure financing at favorable terms. The proprietary ratio components are shareholders’ or proprietary funds and total assets, including goodwill, etc.

How Does GooglePay Earn Money? (GooglePay Business Model Revealed)

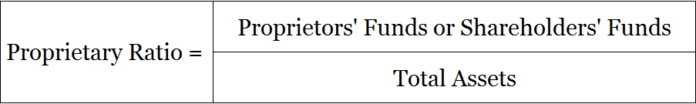

It is calculated by dividing the total shareholders’ equity by the total assets of the company. It is used to assess financial stability, with a higher ratio indicating a stronger financial position. The proprietary ratio (also known as net worth ratio or equity ratio) is used to evaluate the soundness of the capital structure of a company. It should be used in conjunction with the net profit ratio and an examination of the statement of cash flows to gain a better overview of the financial circumstances of a business. These additional measures reveal the ability of a business to earn a profit and generate cash flows, respectively.

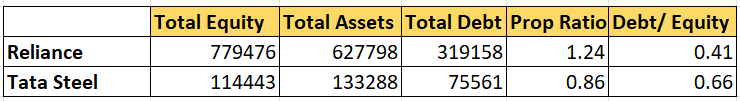

Analysis of assets of the company in relation to proprietary ratio

The proprietary ratio components are shareholders’ or proprietary funds and total assets, including goodwill, etc. The proprietary ratio is also known as the ‘equity ratio’ which indicates the portion of total assets being held by a company that is funded by the proprietors’ funds. The proprietary ratio and the debt-to-equity ratio are both crucial solvency ratios, but they measure different aspects of a company’s financial structure. While the proprietary ratio focuses on the proportion of a company’s assets financed by equity, the debt-to-equity ratio compares the total debt to shareholders’ equity. Proprietary ratio shows the proportion of total assets financed by proprietors’ funds.

Solvency Ratio (or Ratio of Total Liabilities to Total Assets)

Proprietary ratio is a type of solvency ratio that is useful for determining the amount or contribution of shareholders or proprietors towards the total assets of the business. The proprietary ratio is calculated by dividing proprietors’ funds by total assets. Hence, the first method would increase our debt in the company and make us look risky. However, in the second method, the only thing visible in our financial statements would be the rent.

- The higher the ratio, the more the shareholders will expect to receive in a liquidation payout (and vice versa).

- A high proprietary ratio signifies the company’s strong financial position, as a larger portion of its assets is financed by equity.

- But the problem is that the proprietary ratio is not an obvious indicator of whether or not a company is appropriately capitalized.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

The ratio is relevant for investors and creditors interested in understanding how much a company relies on equity rather than debt financing. It is also be used to compare a company’s financial structure over time or with other companies in the same industry. The proprietary ratio is a measure of a company’s financial leverage, which indicates the extent to which it is shareholders’ equity to finance its operations. This ratio is incredibly useful as it highlights the proportion of the total assets of a business that has been funded by the proprietors. Solvency ratios include various metrics such as the proprietary ratio, debt-to-equity ratio, and interest coverage ratio. For example, the debt-to-equity ratio compares the amount of debt a company has to its equity, while the proprietary ratio focuses on how much of the company’s assets are financed by shareholders’ equity.

What is the Proprietary Ratio? How to calculate proprietary Ratio?

The proprietary ratio is calculated by dividing proprietors’ funds by total assets. The proprietary ratio helps you measure how much the company’s stockholders are contributing to the total capital of the company. The proprietary ratio is a key solvency ratio used to assess a company’s financial stability by analyzing how much of its total assets are funded by shareholders’ equity. It provides insight into a company’s financial leverage and is critical for investors and creditors. In this blog, we’ll explore the meaning, formula, and significance of the proprietary ratio in detail.

While a high why the irs discontinued the e may be attractive for an early-stage startup, the company may have limited earning potential and require substantial investment to grow. Furthermore, the proprietary ratio indicates the amount that shareholders would receive in the event of company liquidation. It is usually expressed as a percentage and is calculated by dividing the shareholders’ equity by the total assets of the business. The proprietary ratio establishes the relationship between the funds provided by the “proprietors” and the company’s total assets.

When a company’s proprietary ratio is high, it means that it has enough equity to be able to support its ongoing business operations. The proprietary ratio allows you to estimate the company’s capitalization used to fund the business. A higher Proprietary Ratio, close to 1 or 100%, is generally considered good as it signifies that a larger proportion of the company’s assets are backed by the shareholder’s equity. However, a suitable ratio can vary depending on the industry and individual company circumstances.